- Home

- About

businesses at all stages of growth.

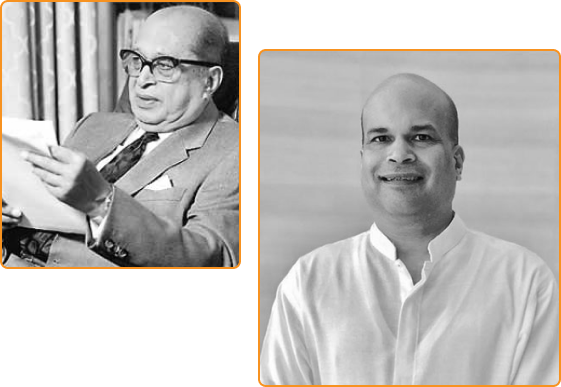

History

The foundations of MMBL-Pathfinder can be traced to the business group founded by Deshamanya N.U. Jayawardena, the first Sri Lankan Governor of the Central Bank, Senator, financier and philanthropist over 60 years ago. Today, the third generation of his family led by his grandson Milinda Moragoda overlook a group of professionals who manage the MMBL-Pathfinder portfolio.

Shareholders

MMBL-Pathfinder is controlled by high net-worth shareholders who have access to a strong network of institutions and individuals from around the world.

Subsidiaries and affiliate companies

We have subsidiaries and affiliate companies located in both Sri Lanka and abroad that provide comprehensive support services to portfolio companies. This includes Pathfinder Management Services Ltd. and Pathfinder Security (Pvt) Ltd. in Sri Lanka as well as MMBL International in Hong Kong.

Strategic Partners

Our exceptional group of strategic partners consist of both institutions and individuals. These partners are often a source of high-quality investment opportunities, industry-specific knowledge, technological know-how, management talent and transaction-specific equity and debt financing.

WHY US

MMBL-Pathfinder: Expertise, Innovation, and Strategic Partnerships

Broad base of Experience

The MMBL-Pathfinder team of executives has substantial experience in the private equity investment business, brand/franchise management, investment banking, accounting, law, general management, management consulting and project promotion.

Creative Transaction Structuring

The experience acquired in raising resources for new ventures, acquisitions and restructuring-related financing enables our team to develop innovative capital structures. By using public and private sources of debt and multi-tiered capital structures, and by identifying strategic partners, we ensure that the acquired company/new venture has the appropriate capital structure to support the company’s growth and maximize equity value.

Capital Market Strength

Our investment track record and reputation for providing thorough pre-acquisition due diligence and post-acquisition strategic, operating and project development support to portfolio companies have helped us to develop excellent relationships with select international and local investment banks, financial institutions and high net-worth individuals. These relationships often enable us to obtain advantageous financing with superior terms and rates.

Strategy Development Capability

Our professionals are experienced in providing extensive analytical, strategic and operating support to portfolio companies.

Strong Corporate Relationships

MMBL-Pathfinder has participated in many transactions in partnership with large corporations and high net-worth individuals from Sri Lanka and abroad. These transactions have yielded attractive financial and strategic benefits for each party, and have often helped to create additional competitive advantage for the acquired portfolio companies.

Rapid-Response Capability

Our industry expertise, extensive analytical capabilities and fast decision making process allows quick evaluation and closure of transactions which often constrains traditional investment institutions.

Our Sector Expertise

Miuvest consists of two separate investment programs: a traditional venture capital program, focused on early stage investing in healthcare and technology companies

GROUP DIRECTORS

Group Directors

President

Mrs. Y.N. Perera

President

Group Director / C E O

Mr. K. Balasundaram

Group Director / C E O

Group Director

Mr. Bernard Goonetilleke

Group Director

Group Director

Deshamanya M. D. D. Pieris

Group Director

Group Director